The Cranky Consumer

Ben McCue, CFA, Investment Research Analyst

In 2021, the US economy continued to rebound after the ups and downs of 2020. Household wealth and consumer balance sheets are in the best shape in years helped by a strong stock market and rising home valuations. The Bureau of Labor Statistics estimates that the most recent unemployment rate reading of 3.8% is approaching the pre-pandemic level while 11 million job openings have fueled wage growth of 5% in 2021, well above the pre-pandemic trend of about 3%. Despite these positive developments, the ongoing issue of inflation has created a sense of uneasiness for many consumers.

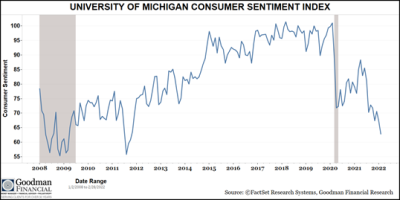

The most recent University of Michigan Consumer Sentiment Index, a measure of how optimistic consumers feel about their finances and the state of the economy, indicates that US consumer confidence has fallen to the lowest level in more than a decade. Consumer sentiment for February showed the overall index at 62.8, a drop of 6.5% from January and down 18.2% from a year ago (see chart).

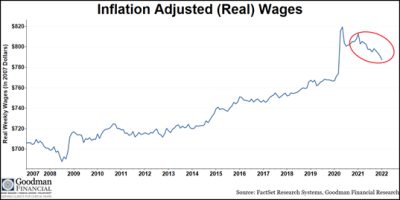

We believe the decline in consumer confidence can be partly attributed to factors including Covid fatigue, the end of government stimulus, and unaffordable housing for new home buyers. However, in our view the single largest factor weighing on consumers has been persistent inflation, which we have discussed previously but seems to have caught many consumers off guard. Temporary shutdowns and supply chain challenges coupled with heightened demand for goods have given way to product short-ages of everything from automobiles to furniture and these challenges have yet to be fully resolved. Food, fuel, and rent costs are all rising at the fastest clip in over four decades, with prices increasing over the course of months compared to prior periods of high inflation such as the 1980s when prices also increased substantially but over the course of a decade. The Consumer Price Index, a measure of inflation, has increased to 7.5% annually in January compared to an increase in wages and salaries of 5.0% for the 12-month period ending in December 2021. As seen in the accompanying chart, this has resulted in a recent de-cline in inflation-adjusted (real) weekly wages after a long period of rising real wages. Thus, rising inflation has offset higher wages leading to diminishing consumer purchasing power.

We believe consumer sentiment is an important indicator of the expected direction of the economy and can be a self-fulfilling prophecy to the extent that it does impact future spending considering consumer spending accounts for approximately 70% of GDP. Clearly, recent inflation has weighed heavily on sentiment but has yet to show up in consumer spending which has remained strong since mid-2021. Accordingly, we will continue to monitor consumer sentiment, consumer spending and inflation, along with other indicators, for signs of economic softness and believe that the current sentiment level, while concerning, does not necessarily indicate an impending recession.