Financial Terms from A to Z

Diana Castro, CPA, CFP® | Senior Financial Advisor When it comes to financial planning and investing, the media tries to grab your attention with catchy news bites using buzzy financial terms such as “The Market” and “The Fed.” Here at Goodman Financial (GFC), we use many of the same financial terms during our market commentary […]

Self-Funding Long-Term Care

By: Antonio Castillo | Associate Advisor Long-term care is probably one of the biggest elephants in the room. In 2016, the Office of the Assistant Secretary for Planning and Evaluation published a research report indicating that most Americans underestimate the risk of developing a disability needing long-term services and support. The report also said that […]

Retirement Planning Success: Impact of Market Declines on Monte Carlo Simulations

Abrin Berkemeyer CFP®, AIF®, Associate Advisor As we know, markets move in three directions: up, down, and sideways. When the market declines, it can leave many wondering “am I still on track to meet my financial goals?” Monte Carlo simulation is one tool within a financial plan that can help address this question. Monte Carlo […]

New Year, Fresh Start: A Financial Planning Checklist for the New Year

Chelsea A. Benoit, CFP®, Associate Advisor The new year typically ushers in fresh opportunities and an energy of renewal. This time of year encourages people to pause and reassess which areas of their lives they would like to enrich. Some people may decide to commit to being more active, while others may set their sights […]

Insurance Review: Making Sure You Have the Right Protection

Diana Castro, CPA, CFP®, Associate Advisor It is the time of year when notifications for open enrollment for employer benefits, Medicare, health insurance marketplace, etc. start appearing in inboxes and mailboxes. Therefore, those tend to be top of mind. However, we recommend using this time to review ALL insurance policies including life, disability, long-term care, […]

The Concept of Asset Location: What is it and why is it important?

By: Steve VanNostrand, CFP®, Senior Financial Advisor For decades, asset ALLOCATION -balancing risk and reward in one’s portfolio by diversifying investments across asset classes like equities, fixed income, and cash has been the cornerstone of portfolio design. However, focusing on allocation alone may mean missing out on the opportunity to maximize portfolio tax efficiency. When […]

Protecting Yourself Online

There is a proliferation of articles in the news these days about cybersecurity. As more and more people share an increasing amount of detail about their life online, cybersecurity becomes an ever more important issue, especially when it concerns your financial life. There are several measures that you can take to help protect yourself. Don’t […]

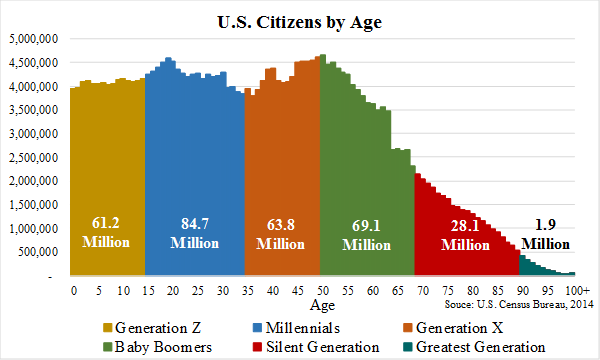

Millennials: Late to the Party, Right on Time for the Economy

Millennials have suffered, or perhaps provoked, the ire of their elders for how slowly they have matured. The largest generation in American history—84.7 million versus 79 million when the Baby Boomers’ were in their 20s and 30s—has rewritten the playbook for adulthood. As of yet, Millennials have delayed embracing marriage, parenthood, and homeownership due in […]