Simplifying Bonds: Pricing & Interest Rates

Chris A. Matlock, CPA, CFA, Chief Investment Officer Bonds can be a daunting subject. You see their prices changing and yields varying, but how does all that work? What happens to bond prices as interest rates change? This article will attempt to provide investors with a better understanding of the relationship among market interest rates, […]

The Cranky Consumer

Ben McCue, CFA, Investment Research Analyst In 2021, the US economy continued to rebound after the ups and downs of 2020. Household wealth and consumer balance sheets are in the best shape in years helped by a strong stock market and rising home valuations. The Bureau of Labor Statistics estimates that the most recent unemployment […]

Fixed Income – Does it belong in your portfolio?

By: Ben McCue, CFA, Investment Research Analyst For much of the last few decades interest rates have been steadily declining and, with the onset of the COVID pandemic, rates are now at historic lows (see U.S. 10-Year Treasury Rate chart). Accordingly, we occasionally hear from clients, “why bother with fixed income when rates are so […]

Bitcoin Revisited

We last wrote about bitcoin in our Spring 2018 Newsletter article titled Bitcoin, Bubbles, and the Fear of Missing Out, which was written just about the time that Bitcoin prices were peaking near $18,000. Within a year, the price of a bitcoin dropped be- low $4,000. Fast forward 3 years and we see bitcoin recently […]

Mighty Mid-Caps

Our clients have long heard us espouse the value of having some exposure to small-cap stocks, referring to Morningstar/Ibbotson data that evidences how small-caps have outperformed large-cap stocks over extended periods of time. But what about mid-cap stocks? While we include them as an important part of our clients’ portfolios, mid-cap stocks get little mention […]

Bitcoin, Bubbles, and the Fear of Missing Out

We thought it would be instructive to share some of the thoughts from our response on December 21, 2017 to a client query about Bitcoin. This article highlights and expands on those thoughts. There is something in human nature that compels individuals to want to invest in things that have already gone up tremendously in […]

Impact of Robo Advisors

As seen in the Forum Magazine Robo-advisors have become a favorite topic for the personal finance press. They would have readers believe that traditional financial advisors should begin packing their desks and updating their resumes. The end is nigh! The truth is, while some advisors may feel pinched by competition, many will not. A parallel […]

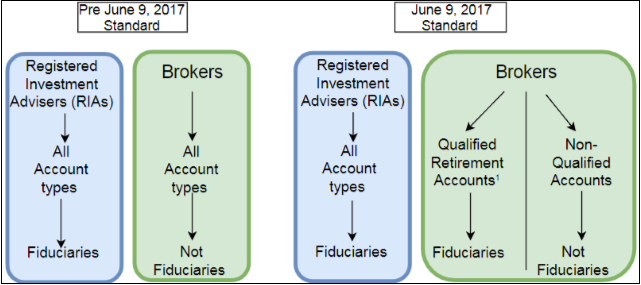

Fiduciary Duty in the News

While the term fiduciary is one familiar to those in the legal profession, it previously did not get much play in the financial or mainstream press. While Goodman Financial has always been held to the fiduciary standard, the majority of financial advisors (regardless of what they call themselves) are not. For years, while prominent financial […]

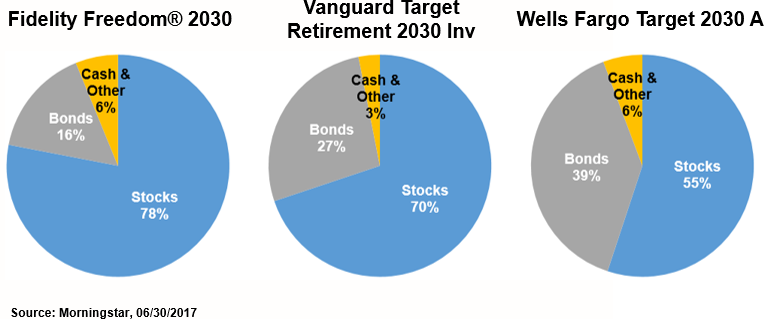

Risks in Employer Retirement Plans

We visit with prospective and current clients who have substantial wealth in their employer sponsored retirement plans such as a 401(k) or 403(b). While it’s well documented that many pension plans are underfunded and their future benefits subject to risk; it’s less well known that embedded risks exist within other employer plans. First among these […]

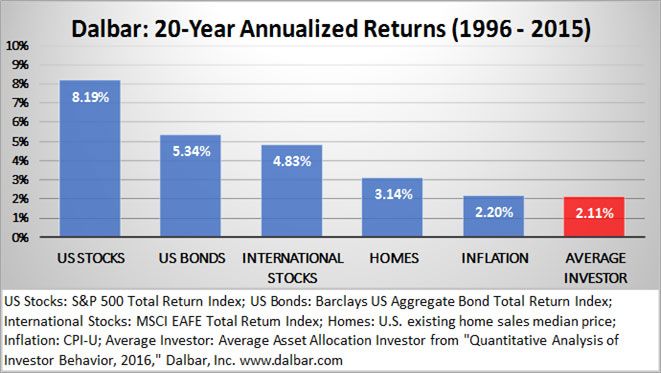

Emotions: An Investor’s Worst Enemy

Many species, including humans, have sought security in herds and the familiar. While this behavior has ensured our survival over the centuries, it is unfortunately detrimental to investing. In an effort to mitigate losses and maximize gains investors take a short-term approach that is rarely beneficial in the long term. Emotions and near-sighted investing go […]