Welcome to Goodman Financial

Culture, Character and Integrity

Working to Exceed Client Expectations

At Goodman Financial, we don’t drop the ball. We have been fiduciaries since day one, meaning that we have an obligation to provide investment advice in our clients’ best interests; and, we owe our clients a duty of undivided loyalty and utmost good faith. We listen to you carefully to understand your particular goals and needs so we can personalize our investment approach to your unique situation. This tailored approach to determining and delivering the appropriate investment framework for each client and our prudent portfolio management are the cornerstones of our company.

Results in Numbers

(as of 03/01/2024)

Clients' best interest is our top priority

Experience the Difference

Serving Clients Since 1989

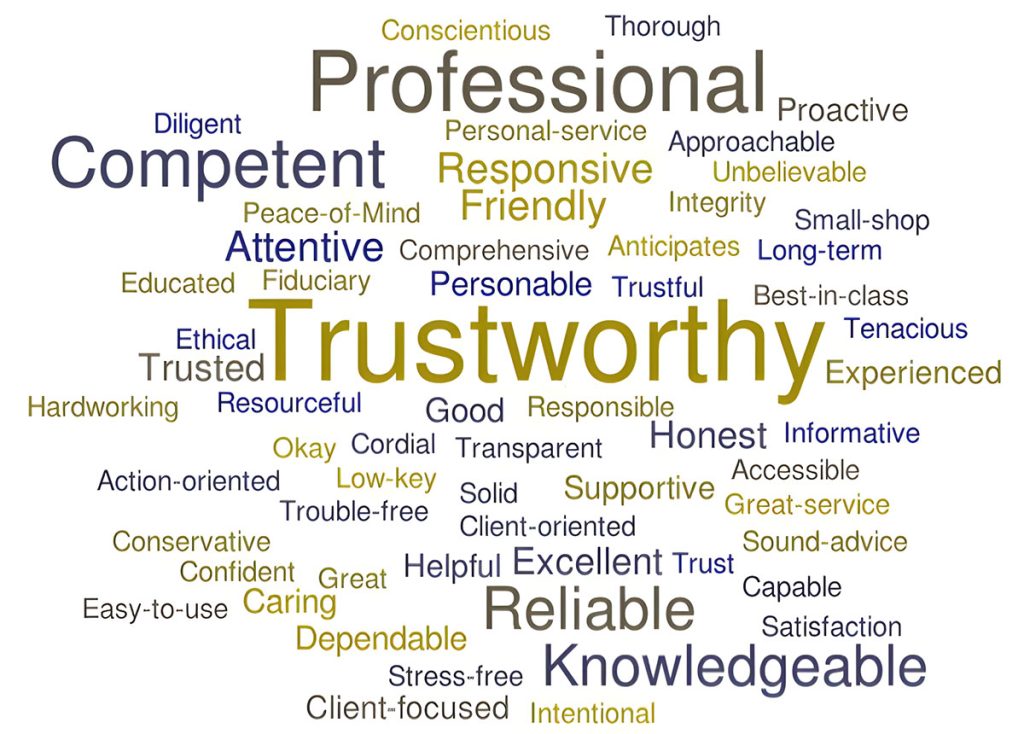

What Our Clients are Saying

From investment management to financial advisory services, we take a personalized approach to help our clients achieve their financial goals.

Here’s what our clients have to say about working with us:

Trustworthy

Professional

Competent

Reliable

Knowledgeable

These testimonials were provided by current clients of Goodman Financial in response to our 2023 Client Satisfaction Survey. These clients were not compensated for these testimonials. No material conflicts of interest exist since these clients were not compensated nor did they receive any other benefit for providing this content.

Let Us Help

Choose Your Financial Path

Individuals and Families

Whether you’re interested in saving for retirement, multi-generational wealth accumulation and planning, taking tax-efficient distributions to fund retirement, or have won the lottery or come into unexpected wealth, we can meet your financial advisory and investment needs. We will develop a portfolio appropriate for your situation that positions your assets to meet your unique needs and goals.

Institutions

We’re prepared to serve institutional clients such as nonprofits, pension funds, foundations, endowments and associations. We apply the same personalized approach to our institutional clients as we do to our individual clients. We focus on your investments so you can focus on your mission.

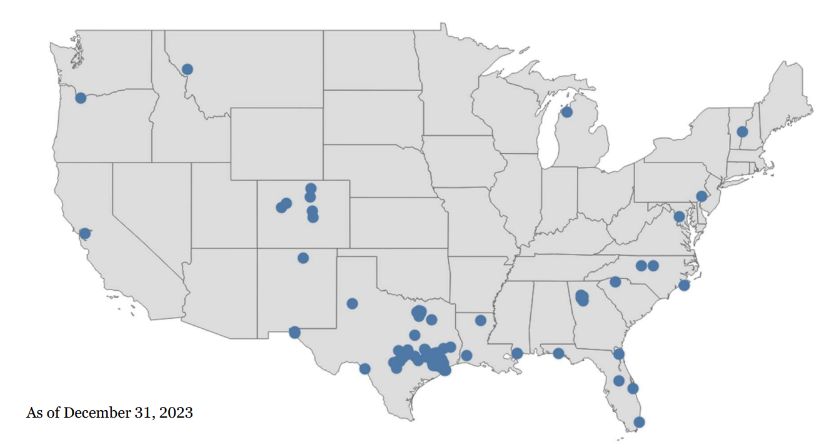

Serving the Nation

Serving Clients in Texas and Across the U.S.

Our goal is to meet the sophisticated financial needs of clients through prudent and personalized money management and financial advisory services. We present advice and solutions tailored to the unique needs of each client.