The Concept of Asset Location: What is it and why is it important?

By: Steve VanNostrand, CFP®, Senior Financial Advisor

For decades, asset ALLOCATION -balancing risk and reward in one’s portfolio by diversifying investments across asset classes like equities, fixed income, and cash has been the cornerstone of portfolio design. However, focusing on allocation alone may mean missing out on the opportunity to maximize portfolio tax efficiency. When tax management is important, implementing a solid asset LOCATION strategy, along with having a solid allocation in place, can potentially help one lower their tax bill. So, what is the concept of asset location? Generally, it is a tax-minimization strategy that leverages the fact that different types of investments have different tax treatments. Understanding these distinctions can help you strategically position your investments between taxable, tax-deferred, and tax-free accounts. To further the concept, let’s first look at the definition of each of the above-mentioned account types.

- Taxable -Offers no tax breaks for contributions and requires 1) ordinary income taxes be paid yearly for ordinary dividends, interest, and short-term gains and 2) capital gains taxes be paid on qualified dividends and long-term capital gains when assets are sold. An example here is an individually or jointly owned taxable brokerage account.

- Tax-deferred -Allows you to save now and delay paying taxes until the funds are withdrawn. Growth and income in these accounts are tax deferred and withdrawals are taxed as ordinary income. Some examples here include 401(k)s, 403(b)s, and IRAs.

- Tax-free -Requires all taxes be paid up front. You save after-tax dollars and avoid further taxation. Growth, income, and future withdrawals are tax free. Roth IRAs, Roth 401(k)s, and Roth 403(b)s are common examples of tax-free accounts.

To be clear, implementing the appropriate asset location strategy is not a one-size-fits-all endeavor and you, your advisor, and/or CPA should conduct a thorough financial analysis before moving forward with any approach. The best location for your assets depends on factors such as your financial profile and investment time horizon, as well as, the expected holding period, tax status, and return characteristics of your portfolio’s securities. In addition, current and upcoming tax law should be considered. Overall, there are a few key questions you should think about when considering asset location strategies. I’ve included them below.

Who Benefits from Asset Location Strategies?

Generally, you get the most benefit if you have both taxable and tax-deferred accounts. If you have tax-free investments, that is even better. Moreover, when you carry a balance of both equity and fixed income in your portfolio, you typically have more flexibility to leverage asset location strategies. Even if your portfolio isn’t balanced with stocks and bonds, you still may find some benefit.

How Does Asset Location Minimize Taxes?

For asset location purposes, how a security is taxed typically determines where it should be located. Long-term capital gains and qualified dividends (usually associated with stocks) are given favorable tax treatment (0%, 15%, or 20%) and are dependent on taxable income. Taxable interest (often from bonds) and ordinary dividends are taxed at ordinary income rates based on your tax bracket (up to 37% based on current tax law). Thus, skewing equity toward a taxable account and fixed-income (not including municipal fixed income) toward a tax-deferred vehicle could improve portfolio tax efficiency. Although this skewing strategy is favorable in many instances, it isn’t always the case as your current and future tax brackets can significantly influence the appropriate skewing of accounts.

Which Investments are Considered Tax-Advantaged, and Which are Not?

Generally, the below assets are relatively more tax advantaged (tax efficient) and, depending on your situation, could be skewed toward a taxable account.

- Individual stocks (in particular, if bought and held for at least a year)

- Equity index mutual funds and Exchange-Traded funds (ETFs)

- Equity funds that state one of their main goals is tax efficiency

Alternatively, the below assets are typically less tax advantaged (tax inefficient) and a skewing toward a tax-deferred account could be beneficial.

- Bonds and bond funds (except tax-free municipal bonds and funds)

- Actively managed stock funds with high turnover rates

Is an Asset Location Strategy a Good Move? Questions to Consider?

- What is your current income tax bracket? Typically, the higher the income tax bracket, the bigger the potential benefit of asset location.

- Do you have large balances in tax-inefficient investments held in taxable accounts? Often, the larger this position, the more advantageous asset location becomes.

- Do you have a long time horizon? Usually, the longer the time horizon, the more benefits you receive from strategic asset location.

- What are your projected future tax-deferred account required minimum distributions? Tax-efficient asset location could be helpful in instances where reduced RMDs are preferable.

- How does your portfolio fit into your legacy goals? Solid asset location strategies can help make your accounts more beneficiary friendly.

Wrapping it All Up with Key Takeaways!

- Implementing appropriate asset allocation AND asset location strategies is key to a successful portfolio management plan.

- Asset location helps create tax efficiency in a portfolio by placing each dollar in a meaningful tax-now, tax-later, or tax-never investment bucket.

- Selecting the best location for a particular investment can be complicated and you should consider working with your CPA and Senior Financial Advisor to determine the best approach.

Whether it’s managing risk for our clients through strategic asset allocation OR leveraging asset location strategies to create maximum tax efficiency, our team at Goodman Financial works closely with our clients and tailors each portfolio to meet their specific financial needs. If you’d like to discuss this topic in more detail, please feel free to call or email your GFC Senior Financial Advisor.

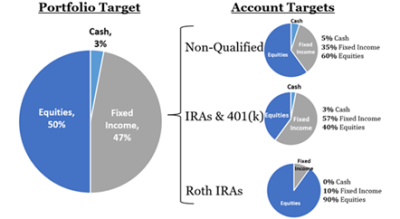

Sample Tax-Efficient Allocation by Account