Tax Efficiency Planning for Recent Retirees

We are highly focused on tax efficiency in every aspect of planning for our clients – from which accounts dividend and interest-earning securities are located in to annual capital gain/loss harvesting. One area we also target is tax-efficient distribution strategies in retirement. When looking at this, we like to view planning opportunities during three different time periods:

- Distributions Prior to Age 59.5 – Pre-59.5 distributions from non-Roth retirement accounts typically incur a 10% early distribution penalty unless they meet one of a few exceptions (there are notable exceptions for 401(k) accounts), so careful planning is required in order to avoid unnecessary taxation and penalties.

- Distributions After Age 70.5 (Required Minimum Distribution, or RMD) – Most non-Roth retirement accounts typically require taxable distributions in the year a person turns age 70.5 and beyond. These RMDs can be sizeable, depending on the balance of the accounts.

- Distributions After Age 59.5 but Prior to 70.5 – This time period, which is the focus of this article, can be a period of reduced taxable income, and therefore can be rife with planning opportunities.

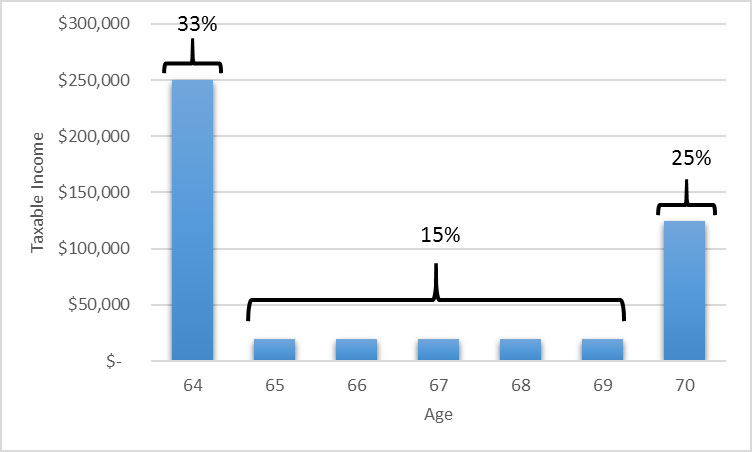

The years leading up to retirement are typically a taxpayer’s peak earning years, and therefore typically land the taxpayer in the highest tax brackets they have or ever will be in. Also, as people tend to have at least half or more of their assets in qualified plans (401(k), 403(b), etc) or traditional IRAs during retirement, they typically find themselves subject to larger taxable RMDs once they reach age 70.5. This creates a “valley” in taxable income levels in the years between retirement and RMD age. See the table above for the tax brackets of a married retiree filing a joint return as an example of this income “valley.”

For the 64 year old retiree above, being in the 15% tax bracket for the 5 “valley” years represents an opportunity to save 10% in federal income taxes on taxable IRA distributions taken prior to age 70.5, to the extent he/she remains in the 15% tax bracket. Additionally, and perhaps more significantly, long-term capital gains (LTCG) or qualified dividends (QD) get even more favorable treatment under current tax law for this taxpayer in the 15% tax bracket. Currently, LTCG and QD are taxed at 0% for taxpayers in the bottom two (10% and 15%) tax brackets, 20% for taxpayers in the top (39.6%) tax bracket, and 15% for all other tax brackets. To the extent that the taxable income in the 10% or 15% tax brackets consists of long-term capital gains or qualified dividends, that tax-favored income will be taxed at 0%, resulting in a tax savings of 15% on these capital gains and dividends.

There are complicating factors that don’t make this analysis so cut-and-dry. For instance, assume our taxpayer is in these valley years, but has begun receiving Social Security benefits. Generally, for married taxpayers with base income of $32,000 for Social Security purposes, none of the Social Security benefit is taxable; taxpayers with base income in excess of $44,000 have 85% of their benefits taxed, and taxpayers between base incomes of $32,000 and $44,000 can have up to 50% of their Social Security benefit taxed. Triggering IRA distributions or capital gains for our client in the example on page 1 would have the effect of making previously nontaxable Social Security benefits now taxable. This reduces the tax benefit of triggering the additional taxable IRA distributions or long-term capital gains. Additionally, any potential tax law changes could change the calculus on this analysis.

Where applicable, we analyze these situations in detail for our clients so that we can help provide them with a higher after-tax, net of fee return. Being tax efficient in distribution/gain-loss strategy as well as portfolio construction can add years to the longevity of a client’s portfolio.