Stressed Out Supply Chains

Chris A. Matlock, CPA, CFA, Chief Investment Officer & Ben McCue, CFA, Investment Research Analyst

It’s  hard to open a newspaper, turn on the TV, or read a corporate earnings report without hearing about the current, dismal state of the global supply chain, which is experiencing unprecedented challenges across shipping ports, trucking routes, railways, and warehouses; and creating shortages of key manufacturing components, order backlogs, and delivery delays, resulting in rising transportation costs and consumer prices as well as empty store shelves.

hard to open a newspaper, turn on the TV, or read a corporate earnings report without hearing about the current, dismal state of the global supply chain, which is experiencing unprecedented challenges across shipping ports, trucking routes, railways, and warehouses; and creating shortages of key manufacturing components, order backlogs, and delivery delays, resulting in rising transportation costs and consumer prices as well as empty store shelves.

How did we get here? The reasons are many, but following are some of the major causes of disruption:

- Early in the pandemic there was a massive rerouting of many cargo ships and shipping containers in order to transport masks and medical equipment to developing countries (many of which have yet to return to normal circulation).

- The COVID pandemic caused long production facility shutdowns globally, causing shortages of all sorts of parts (especially semiconductors) needed for further manufacturing.

- Due to an inability to spend money on services (think hospitality and travel), consumers shifted their spending to goods –further fueled by massive fiscal stimulus payments.

- Many workers left the labor force during the pandemic and have yet to return, causing labor shortages everywhere.

Exacerbating the situation are longer-term trends such as companies embracing “Just-In-Time” inventory management (holding low inventory and ordering only as needed), railroads’ adoption of “precision scheduling” (fewer trains running longer routes), a shortage of truck drivers across the country, a container shipping capacity shortage, and limited warehouse capacity driven by soaring e-commerce demand.

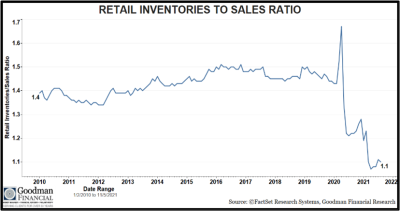

When will it end? Most experts expect to see significant improvement in supply chain issues for many products by the second half of 2022. But, for some industries with complex supply chains (like semiconductors), the situation is especially difficult, and those may not return to normal until 2023. This will likely result in production delays for other products such as automobiles, appliances, mobile phones, and computers that rely on those parts. Moreover, the upcoming holiday season may place increased pressure on the already struggling supply chain and any additional COVID-related shutdowns would only add to the strain. This has already resulted in wide shortages of all sorts of products, as seen in the nearby chart, which shows inventories at an all-time low relative to underlying sales of those products.

When will it end? Most experts expect to see significant improvement in supply chain issues for many products by the second half of 2022. But, for some industries with complex supply chains (like semiconductors), the situation is especially difficult, and those may not return to normal until 2023. This will likely result in production delays for other products such as automobiles, appliances, mobile phones, and computers that rely on those parts. Moreover, the upcoming holiday season may place increased pressure on the already struggling supply chain and any additional COVID-related shutdowns would only add to the strain. This has already resulted in wide shortages of all sorts of products, as seen in the nearby chart, which shows inventories at an all-time low relative to underlying sales of those products.

What does it mean for companies, consumers, investors, and the economy? Until the supply chain issues are sorted out, delays in inputs could lead to a decline in manufacturing (which could lower US GDP) and rising costs, which may result in lower corporate profit margins to the extent that those costs cannot be passed on to consumers. Additionally, rising costs and inflation may reduce consumer spending and impact company profits through lower sales volume, lower profit margins, or both. While resolving these issues will take time, the good news is that doing so will likely result in a more elongated economic recovery than might otherwise be the case. The Federal Reserve (Fed) is operating under the assumption that the current supply chain bottlenecks are transitory in nature and thus expects inflation to level off once the supply chain returns to normal. However, policymakers may have to tighten monetary policy by raising interest rates sooner than planned if these expectations are not met.

What does it mean for GFC investments? We believe fixing supply chains will be harder and take longer than many expect. We also believe this will cause inflation to be higher and more persistent than the Fed would like to believe, leading to higher interest rates. Accordingly, we have taken a more defensive posture with our equity holdings and are keeping our bond ladders short, with the expectation of reinvesting maturing bonds at higher interest rates.