Self-Funding Long-Term Care

By: Antonio Castillo | Associate Advisor

Long-term care is probably one of the biggest elephants in the room. In 2016, the Office of the Assistant Secretary for

Planning and Evaluation published a research report indicating that most Americans underestimate the risk of developing

a disability needing long-term services and support. The report also said that “Many Americans prefer not to think about

this need for assistance or who will provide it”.

Long-term care is a range of services designed to meet a person’s health or personal care needs during a period of time.

Most long-term care is not medical care, but rather assistance with the basic personal tasks of everyday life, called

Activities of Daily Living, such as: bathing, dressing, using the toilet, transferring (to or from bed to chair), caring for

incontinence, and eating. Among the main reasons people would need this type of care are having an accident-causing

disability, and chronic conditions such as diabetes and high blood pressure. Additionally, cognitive illnesses such as

Alzheimer’s, which has an average life expectancy after diagnosis of 8 to 10 years, much of which may require support

care.

Since the above costs are not covered by health insurance (including Medicare), the statistical fact is that someone

turning age 65 today has almost a 70% chance of needing some type of long-term care services and support in their

remaining years suggests that we all should factor this into our retirement planning. At some point, each of us must make

the determination whether we can afford to self-fund for our long-term care or if insurance needs to be purchased to

transfer this risk. We do want to note that there is a standalone or traditional long-term care insurance market; however,

it is declining due to rising premiums and exit of insurers.

To make an educated decision, we would first need to assess the likelihood of needing care and then estimate the cost.

With that knowledge, we could then look at whether our net assets, factoring care costs, spending rate, and time horizon,

are up to the challenge.

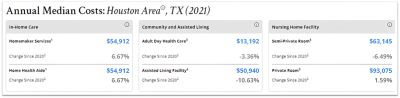

One of the leading references for long-term care costs is the Genworth Cost of Care Survey. According to their latest

published report, this is the annual median cost of care in the Houston area in 2021:

The same report defines the different types of care settings as follows:

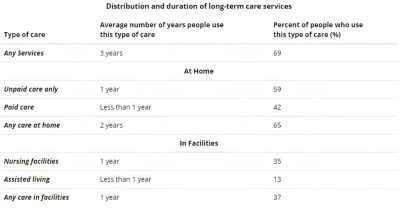

Although the data vary about average duration of care, most of the statistics converge in the 3-year range, as shown in

the table below from longtermcare.gov:

Hiring in-home care seems to be the most preferred and at the same time affordable alternative: around $55,000 per year

versus $93,000 per year for a private room in a nursing home facility. However, it’s important to remember that most other

household expenses would continue with in-home care, whereas in a facility, some of these will be included. If your

portfolio is sufficient to cover your planned retirement expenses plus the additional long-term care costs, self-funding may

be the answer. If your plan is tight, purchasing some type of insurance even if it seems costly may be the right way to go,

but you shouldn’t wait too long to discuss this because the older we get, the more cost prohibitive the premiums become.

An initial conversation to get the ball rolling can go a long way. The risks and costs of long-term care are among the most

important considerations in retirement, and given the potential impact on assets, the dialogue can be beneficial.

If you would like to further discuss planning for long-term care or any of your planning needs, please feel free to reach

out to your Goodman Financial Advisor at (713) 599-1777.