Risks in Employer Retirement Plans

We visit with prospective and current clients who have substantial wealth in their employer sponsored retirement plans such as a 401(k) or 403(b). While it’s well documented that many pension plans are underfunded and their future benefits subject to risk; it’s less well known that embedded risks exist within other employer plans. First among these is each participant has the ultimate responsibility to ensure the investment(s) he or she chooses are appropriate for their goals and objectives. Stated differently this means each plan participant assumes all the investment risk. In practice, this is often overlooked as participants have become more passive in the management of their wealth. Without a proactive investment strategy or plan, unexpected or unsatisfactory retirement and investment outcomes may increase. To reduce this possibility, a plan participant should contemplate the following.

- Determine his/her overall asset allocation and how a plan’s available investment choices are expected to support it. While some participants may default to either index or target date investment options, this methodology effectively diminishes the importance of their own needs and risk profile. More on this below.

- Conduct a periodic review of all existing investment choices. The details of this review are outside the scope of this article. However, it should be comprehensive and integrated within the full context of one’s retirement and investment planning. In terms of investment performance, consider the circumstances of how a return were earned. For instance, an investment that earned a 10% return vs. one that had a 7% return could have assumed excessive risk to achieve that outcome.

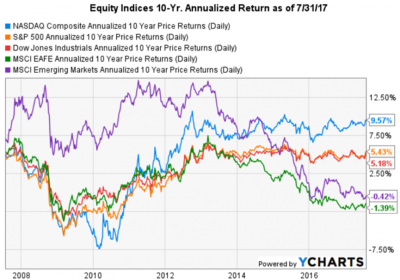

- While index investments can be less costly, they still contain risks. Knowing the makeup of an index, how its value is determined, and whether one index has significant overlap with another are just a few

of the metrics an investor should be aware. The chart to the right illustrates the wide divergence of 10-year annualized returns of well-known equity indices. A plan participant should understand why the differences in returns have occurred. There is a relationship between risk and return and it fluctuates. Recognizing this and with a current strategic investment plan in hand any changes that would be appropriate can be implemented accordingly. Otherwise, it’s akin to flying a plane without a flight plan. A risky flight indeed!

of the metrics an investor should be aware. The chart to the right illustrates the wide divergence of 10-year annualized returns of well-known equity indices. A plan participant should understand why the differences in returns have occurred. There is a relationship between risk and return and it fluctuates. Recognizing this and with a current strategic investment plan in hand any changes that would be appropriate can be implemented accordingly. Otherwise, it’s akin to flying a plane without a flight plan. A risky flight indeed! - Target date funds are designed to provide a principally passive approach through a portfolio whose asset allocation becomes more conservative as the target date nears. While this appears straightforward, target date funds are not all the same. Perhaps the biggest difference lies in the asset allocation itself.

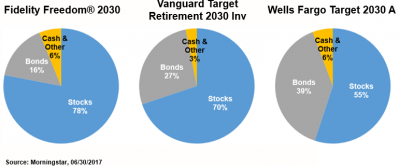

The graphic to the left depicts the asset allocations of three 2030 target date funds as of 6/30/17. Clearly there is disagreement on which asset allocation is appropriate. For a particular investor, none of the above may be applicable. Of course, these allocations will change over time which highlights the need for continued monitoring and coordination with one’s specific circumstances and risk tolerance.

The graphic to the left depicts the asset allocations of three 2030 target date funds as of 6/30/17. Clearly there is disagreement on which asset allocation is appropriate. For a particular investor, none of the above may be applicable. Of course, these allocations will change over time which highlights the need for continued monitoring and coordination with one’s specific circumstances and risk tolerance.

The risks discussed are not all encompassing. Rather a deliberate approach for selecting, monitoring, and changing 401(k) or 403(b) investment options to align with your goals and objectives is imperative. At Goodman Financial, we listen to our clients, understand their goals and objectives, know the risks rooted in 401(k) and 403(b) plans, and work on behalf of our clients to alleviate and manage them.