New Year, Fresh Start: A Financial Planning Checklist for the New Year

Chelsea A. Benoit, CFP®, Associate Advisor

The new year typically ushers in fresh opportunities and an energy of renewal. This time of year encourages people to pause and reassess which areas of their lives they would like to enrich. Some people may decide to commit to being more active, while others may set their sights on checking items off their personal bucket lists. One important area that is critical to review, at least annually, is your financial plan. You want to ensure that you are still on track to accomplish your goals and live the life that brings you joy. Below are a few areas to explore as you and your financial advisor begin planning for the upcoming year.

Goals-Based Planning

Collaborating with your advisor is a very important part of creating and maintaining a successful financial plan. Meeting with your advisor regularly and keeping them up to date on any important life changes or plans provides the advisor a better understanding of your complete financial picture to help you optimize pivotal decisions.

- Are there any new life updates, upcoming plans, or activities that you would like to share with your advisor?

- What have you been able to accomplish regarding the goals or planning items discussed previously, and what is there left to accomplish?

- Do you plan on making any charitable donations this year? How and when do you plan to fund them?

- Are there any accounts that you would like to consolidate to help simplify your financial portfolio?

Cash Flow Planning

Reviewing your planned expenses and expected income sources for the year can help you determine how to best allocate your resources. Notifying your advisor of any upcoming inflows or distributions ahead of time can help them determine how to put those incoming funds to work for you or which distribution strategy would best meet your needs.

- Are you expecting any significant cash inflows this year? Do you plan to use these funds for upcoming expenditures, or could you invest them in your portfolio?

- Do you need to make any adjustments to your monthly distribution amount or the timing of the distribution?

- Will you need to take any one-off distributions during the year? If so, what will be the amount and timing of these distributions?

Retirement Planning

Whether you are saving for retirement or have already entered that chapter of your life, it is important to ensure that you are aware of the income sources available to you, as well as any changes regarding your retirement accounts, Social Security, or Medicare.

- Have you revisited your contributions to your retirement accounts given the updated limits (e.g., IRAs, 401(k)s, 403(b)s, SEP IRAs, etc.)?

- Are you approaching your full retirement age (FRA)? Will you be receiving Social Security benefits? How will that affect your cash flow planning?

- If you will be turning 65 years old this year, will you need to sign up for Medicare? If so, have you considered for which parts you will be signing up?

- Are you aware of any mandatory distributions from your employer plans (e.g., payouts from non-qualified employer plans or pensions)?

- If you will be turning 72 years old this year, will you need to take Required Minimum Distributions? Do you need the distribution to meet current cash needs, or could these distributions be reinvested or utilized to meet your charitable intent?

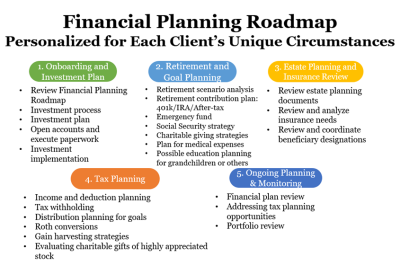

In addition to the items mentioned above, our Financial Planning Roadmap (shown below) is a helpful tool that can be used to pinpoint other target planning areas you may want to address. For instance, you may want to work with your advisor to review your current estate documents for any necessary updates or look over your tax return for any tax planning opportunities that can be utilized in the new year. Your financial advisory team can personalize this roadmap based on your unique financial circumstances and the priorities that are most important to you.

Taking time to review your financial situation annually not only sets you up for success for the current year ahead but over the long-term as well. Your financial advisory team is here to answer any questions you have and help you determine which planning strategies work best for your plan. We want to help you make every year a great one! We wish you and your loved ones an amazing 2022!