Investing In Equities During Turbulent Environments

Successful, long-term equity investing is based on fundamental analysis based on quality information. This prudent approach is not altered by short-term volatility or by short-term tumultuous events. Why? First, it is important to recognize that there has been a long and abundant history of turbulent environments for the equity markets to navigate. For example, The Great Depression, World War II (and several other wars), Black Friday, the Tech Bubble, The Great Recession, Brexit, periods of high and low inflation, numerous blends of fiscal and monetary policies etc. Second, history also contains many positive environments that have more than offset the adverse financial impacts equity markets may have encountered. Logically this must be the case, otherwise the equity markets would have a negative return since inception and this simply has not occurred. Now, I’m not suggesting the only way for equity prices to go is up. Yet, despite countless, negative events, significant market declines, and investor angst during these times the S&P 500 is at or near its highest level ever!

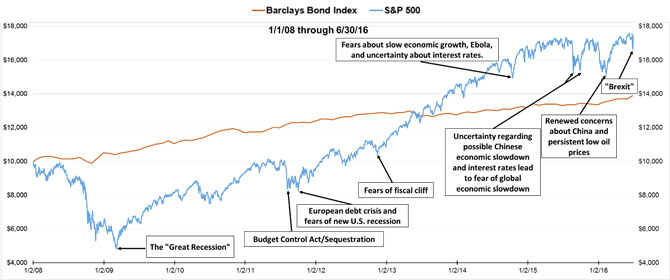

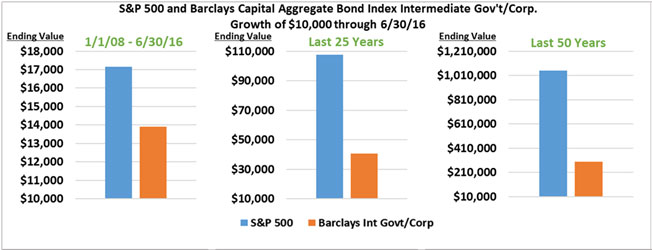

We further this point via the graphs below. Each illustrates positive growth of a $10,000 investment in both the S&P 500 and the Barclay’s Intermediate Bond Index since 2008, and the last 25, 50 and 75 years respectively. The largest graphic is labeled with notable events and although the bar graphs are not “event” labeled, we know history contains numerous examples of both positive and negative happenings. The conclusion is apparent. The equity market (S&P 500) has persevered and produced not only positive returns, but long-term returns well in excess of those associated with fixed income investments.

S&P 500 and Barclays Capital Aggregate Bond Index Intermediate Gov’t/Corp.

Growth of $10,000: During Turbulent Environments

Other key observations:

1) Turbulent events are neither isolated nor rare. These events are what cause volatility in equity markets. And perhaps the more salient point is that investors can and do overreact or misinterpret the “news.”

2) Despite these events, the long-term dominant performance trend for the S&P 500 is positive.

3) Given a meaningful measurement period, fixed income securities typically provide lower returns versus equities as evidenced by a comparison of the S&P 500 vs. the Barclay’s Int/Govt Corp Bond Index.

4) Even though long-term returns for fixed income investments lag those of equities, fixed income securities are a necessary component of a diversified risk-managed portfolio.

In sum, by adhering to a prudent, long-term investment strategy, equity investors will find opportunities even during turbulent environments and often at lower prices.