Insurance Review: Making Sure You Have the Right Protection

Diana Castro, CPA, CFP®, Associate Advisor

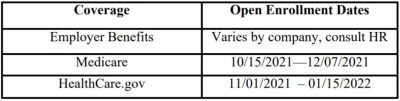

It is the time of year when notifications for open enrollment for employer benefits, Medicare, health insurance marketplace, etc. start appearing in inboxes and mailboxes. Therefore, those tend to be top of mind. However, we recommend using this time to review ALL insurance policies including life, disability, long-term care, homeowners, automobile, and umbrella. Incorporating this review into your comprehensive financial plan ensures you have the protection you need. Let’s start an insurance re-view together.

Health Insurance –Employer, Medicare, and Health Marketplace Exchange

For health insurance coverage, it is important to pay attention to the enrollment dates. Also, note what coverage will continue at the current benefit or require an active election to renew. Take time to review your current coverage and note any changes to costs or benefits such as premiums, deductibles, provider net-work, and prescription drug costs. Think about upcoming needs for each person covered and who can be covered. You may need to add or remove a dependent. If you utilize a high deductible health plan, review your Health Savings Account (“HSA”) to maximize pre-tax dollar contributions. If you contribute to a Flexible Spending Account (“FSA”), review the terms so you do not lose leftover funds. For HSAs, take note of contribution limits as they differ for individual versus family coverage, and those age 55+ are allowed an additional contribution.

Life and Disability Insurance

For employees who enroll in employer sponsored group life insurance, pay attention to the age brackets. Premiums from one age bracket to the next increase by a larger percentage as you get older. This is important when comparing group coverage to outside coverage as you want to consider premiums for the duration of the policy. Some companies offer minimal benefits to spouses and dependents so review eligible participants. For those with outside life insurance policies, review premium schedules and note any upcoming increases whether age-based or time lapsed. Ensure that the coverage amount remains adequate for your needs as some policies decrease the benefit while the premium remains constant. For all life insurance policies, double check your primary and contingent beneficiaries. Disability insurance, whether through group or individual coverage, protects against the loss of future earnings potential. Make sure to review the terms for both short- and long-term disability coverage. Focus on key terms such as the elimination (waiting) period and the policy’s definition of disability. The elimination period determines how much time lapses before you receive benefits, which means you will need funds available to cover the period before your benefits start. The applied definition of disability impacts the premiums and level of protection provided.

Long-term Care Insurance

There are many types of long-term care (“LTC”) policies. They range from traditional policies where a policy holder pays an annual premium for coverage to hybrid policies that have a variety of benefits and add-on features such as cost of living adjustments, reimbursement options and even refund of premiums. Luckily, the process of reviewing your LTC policy is similar to what has already been discussed above. For these policies, focus on your premium schedule and changes in coverage over time. Some LTC policies have a death benefit so review your beneficiaries.

Property & Casualty Insurance – Homeowners, Automobile and Umbrella

For most people, their home and possessions are one of their largest assets. Even if you have not done anything new to your home or purchased valuables, outside factors such as the cost of lumber could impact the rebuild or replacement costs. It is key to ensure your coverage is sufficient for the rebuild cost today. If you have completed any upgrades, a review is critical to ensure the dwelling and other structures are fully covered. You should also complete an inventory of your possessions. This will help determine coverage for personal property, and if extended coverage is needed for valuables such as jewelry or art. For those of you in the Houston area, or anywhere that it rains, flood insurance should be considered in addition to homeowners insurance.

Automobile insurance can protect against damage or loss of your vehicle, bodily injury coverage, property damage and medical payments. It is important to review premiums, deductibles, and maximum coverage for each portion of the policy such as liability or medical coverage. You should also review optional riders to determine if appropriate. Examples include coverage for glass replacement or roadside assistance. There are also opportunities for discounts, so it is good to review those.

Umbrella insurance is not considered a type of property and casualty insurance as it is a liability-only coverage; however, it offers coverage for amounts that exceed your homeowners and automobile policy coverage limits. Relative to the coverage, premiums are inexpensive, which makes this type of policy a worthwhile part of your overall insurance coverage.

Questions to consider for all insurance policy reviews:

- How do I make sure I have the right coverage? What am I trying to achieve with

this policy? This question becomes easier once you get into a habit of reviewing your policies regularly. However, if it has been a while since you looked at your coverage, a more in-depth conversation with either your Goodman Financial Advisor or an insurance partner is recommended. - When can I make changes? Depending on the type of insurance, you may need to wait until open enrollment, or a qualified life event occurs. Some types of insurance, like auto insurance, can be changed at any point, even in the middle of a policy period.

- Do I qualify for discounts? Determine if the insurance company is using a carrot or stick method when calculating premiums. A health insurance company may give a discount to non-smokers or those who complete a physical and fall within certain results (carrot) or charge a penalty to people who smoke or do not show proof of an annual physical (stick). Using the same insurance carrier for multiple policies could result in a bundling discount. Discounts can be offered for owner’s taking precautions like having a home security system. The best thing to do is to ask the insurance representative.

Life changes and the appropriateness and benefits of each policy type change too. What was best for you or your family at one point may no longer be what is best now or in the future. We look forward to assisting you with your insurance review to ensure that there are no gaps in your financial plan and that you have peace of mind knowing you are covered.