Harvesting Gains – An Essential Aspect to Investing

Harvesting investment gains is an important part of enhancing total return, and when and how to do so are crucial factors.

There are several reasons why an equity may be sold when it has done well. The philosophy of “Buy Low and Sell High” is the first possibility, especially if the future prospects of the company indicate the price may decline. A second reason is that the sale of one equity can provide liquidity to purchase a new equity with a more promising future.

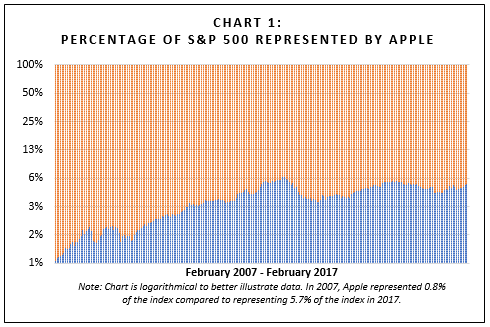

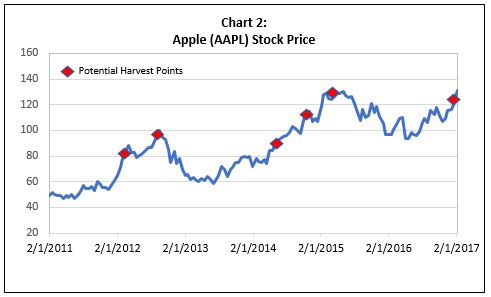

Also, if a stock does well there is the potential for it to become “overweighted”. As its price climbs it becomes more heavily weighted compared to other equities in a portfolio. This can create more volatility in portfolio returns because the portfolio becomes overly influenced by one stock. To mitigate this risk, one can “trim the position” by selling a portion of the stock, thereby harvesting a portion of the gain. We also see this overweighting phenomenon in the S&P 500 index returns and other market weighted index funds. For example, the ten largest companies together, including Apple, comprise 20% of the S&P 500 index. At a $677 billion-dollar market capitalization Apple alone is larger than the bottom 96 companies of the index combined! This creates a situation where Apple’s performance has a disproportionate influence on the returns of the entire S&P 500, as illustrated in the Chart 1. The S&P 500 index, and most other index funds, do not provide the opportunity to trim an individual position but in a portfolio of individual securities the potential to trim a specific equity exists, as notated in Chart 2. Trimming a portion of the position allows one to harvest some gains while reducing risk on a forward basis.

Also, if a stock does well there is the potential for it to become “overweighted”. As its price climbs it becomes more heavily weighted compared to other equities in a portfolio. This can create more volatility in portfolio returns because the portfolio becomes overly influenced by one stock. To mitigate this risk, one can “trim the position” by selling a portion of the stock, thereby harvesting a portion of the gain. We also see this overweighting phenomenon in the S&P 500 index returns and other market weighted index funds. For example, the ten largest companies together, including Apple, comprise 20% of the S&P 500 index. At a $677 billion-dollar market capitalization Apple alone is larger than the bottom 96 companies of the index combined! This creates a situation where Apple’s performance has a disproportionate influence on the returns of the entire S&P 500, as illustrated in the Chart 1. The S&P 500 index, and most other index funds, do not provide the opportunity to trim an individual position but in a portfolio of individual securities the potential to trim a specific equity exists, as notated in Chart 2. Trimming a portion of the position allows one to harvest some gains while reducing risk on a forward basis.

While investment decisions are primarily made to maximize returns, and manage risk, another benefit of selective gain harvesting is the ability to manage tax implications in a more efficient and personalized manner.