Focus on Philanthropy: Learn About Donor Advised Funds

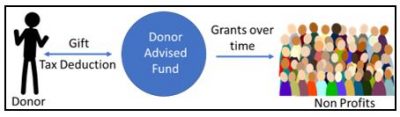

A good deed is a reward in itself, but it can also lead to a reward on your tax return. A donor advised fund (DAF) is a great way to meet your philanthropic goals and exercise tax efficiency at the same time. A DAF is defined as a philanthropic vehicle established at a public charity which allows donors to make a charitable contribution, receive an immediate tax benefit (subject to limitations), and then recommend grants from the fund over time to other public charities.

How could this be helpful to you? Let’s say this year you find yourself in a high tax bracket, and also have a large sum of cash or securities (perfect in a year when you have a large liquidity event or highly appreciated securities); you feel strongly about supporting Charity A and plan to contribute to their cause for the next several years. The idea is you donate to a DAF this year, get the tax benefit now, then recommend to the custodian of the DAF to distribute money to Charity A over the next several years when your marginal tax rate may not be as high. Though it is technically a “recommendation,” the custodian will generally follow the donor’s suggestion.

It’s also popular to utilize a DAF when you have the means to be philanthropic but have not yet identified a charity to support. Another perk of this method is the money you contribute can be invested and grow tax free, meaning more funds could be available for your chosen cause(s). Give us a call to learn more.