Fixed Income – Does it belong in your portfolio?

By: Ben McCue, CFA, Investment Research Analyst

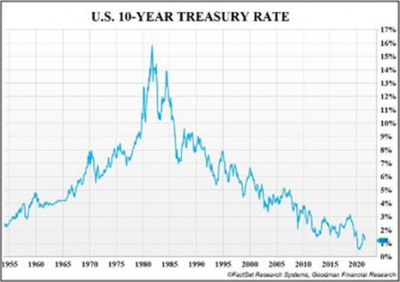

For much of the last few decades interest rates have been steadily declining and, with the onset of the COVID pandemic, rates are now at historic lows (see U.S. 10-Year Treasury Rate chart). Accordingly, we occasionally hear from clients, “why bother with fixed income when rates are so low, and stocks are doing so well?”. Given the current economic backdrop, it is reasonable to ask whether fixed income still belongs in your portfolio at all.

Benefits of Holding Fixed Income

We believe fixed income investments can play a vital role in man-aging overall risk for a diversified portfolio while providing an important source of income. Even at very low yields, bonds generally have held their value or appreciated during significant stock market declines which can help smooth out the volatility in a stock portfolio and lower the overall portfolio risk because stock and bond prices have historically tended to move independently. Additionally, those bonds provide a ready source of cash to redeploy into stocks when the stock market does decline, allowing asset allocations to get back into target levels. Rejecting bonds entirely and going fully into stocks brings its own set of risks, especially at current historically high valuations, which makes it even more important to continue to manage risk. Additionally, bonds offer definitive payments over a certain period of time which can aid financial planning efforts and provide a stable and calculable source of income in the future.

GFC’s Approach to Fixed Income Investing

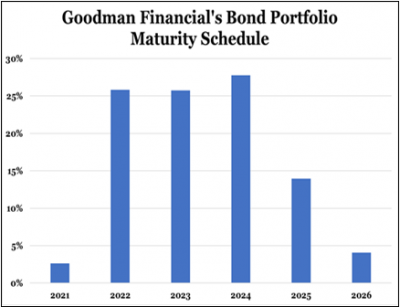

Our approach seeks to maximize yield while controlling the underlying risk to achieve that yield. To accomplish this goal, GFC portfolios are currently invested primarily in shorter maturity, investment-grade corporate bonds using a ladder approach consisting of individual bonds or bond exchange traded funds (ETFs) that mature on different dates, as seen in the ac-companying chart. Note that this is a firm wide ladder and each client’s portfolio will differ.

We believe rates will not always be this low and the ladder approach allows us to take advantage of opportunities that arise if and when rates do go up by reinvesting maturing bonds at higher yields. While rising rates lead to price declines in the short-term, higher reinvestment yields provide an opportunity to generate better returns from that point forward. Keep in mind that bond prices and interest rates have an inverse relationship. As interest rates rise, bond prices fall.

To wrap up, we believe fixed income is appropriate to include in most portfolios for investors seeking to reduce volatility and minimize the risk of significant drops in stocks, while still achieving a superior return to cash alone. Fixed income investments can be complex instruments and should be assessed in a measured and experienced manner. GFC has years of experience managing fixed income investments to maximize yield while controlling risk. If you have additional questions about fixed income investments and how they fit into your portfolio, please reach out to a GFC Senior Financial Advisor.