Fiduciary Duty in the News

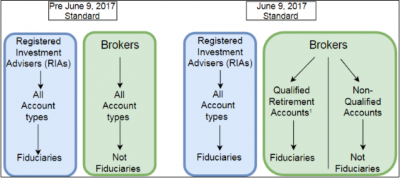

While the term fiduciary is one familiar to those in the legal profession, it previously did not get much play in the financial or mainstream press. While Goodman Financial has always been held to the fiduciary  standard, the majority of financial advisors (regardless of what they call themselves) are not. For years, while prominent financial industry leaders and regulators have attempted to extend fiduciary responsibility to all financial advisors, many in the brokerage profession have lobbied for the status quo. With proposed Securities and Exchange Commission (SEC) guidelines in a perpetual holding pattern, the Department of Labor (DOL) made an end run around financial services industry regulators to require that all advisors follow the fiduciary standard, at least as it pertains to retirement accounts1, the one investment area that falls somewhat under the purview of the DOL. To recap the change, see graphic to the right.

standard, the majority of financial advisors (regardless of what they call themselves) are not. For years, while prominent financial industry leaders and regulators have attempted to extend fiduciary responsibility to all financial advisors, many in the brokerage profession have lobbied for the status quo. With proposed Securities and Exchange Commission (SEC) guidelines in a perpetual holding pattern, the Department of Labor (DOL) made an end run around financial services industry regulators to require that all advisors follow the fiduciary standard, at least as it pertains to retirement accounts1, the one investment area that falls somewhat under the purview of the DOL. To recap the change, see graphic to the right.

Yes, you are seeing things correctly. Brokers may be required to serve their clients as fiduciaries, but only as it permits to advice and management on qualified retirement accounts1. Those same brokers have no fiduciary duty pertaining to all accounts that are not qualified retirement accounts. So, what is that standard for those accounts? It is the standard of suitability, meaning any investment sold has to be suitable for the client, but it does not have to be in the client’s best interest.

The rules have become more confusing at best, but there is more. Proponents of excluding brokers from the fiduciary rules are now pushing back on these new DOL regulations, appealing to the Fifth Circuit Court  of Appeals to overturn lower-court decisions upholding the new rule. The argument is that the DOL exceeded their authority in issuing such a major rule, with the privilege of such rule making first requiring authority from Congress. With these requirements in a possible state of flux, the best way to ensure that your financial advisor is operating as a fiduciary is to make sure they are an SEC registered investment advisor. Goodman Financial is in our 28th year of proudly operating as a fiduciary, putting our clients’ interests first, and ourselves in a place of trust.

of Appeals to overturn lower-court decisions upholding the new rule. The argument is that the DOL exceeded their authority in issuing such a major rule, with the privilege of such rule making first requiring authority from Congress. With these requirements in a possible state of flux, the best way to ensure that your financial advisor is operating as a fiduciary is to make sure they are an SEC registered investment advisor. Goodman Financial is in our 28th year of proudly operating as a fiduciary, putting our clients’ interests first, and ourselves in a place of trust.

1Includes 401(k), ERISA 403(b), IRA, Roth, SEP-IRA, and Simple IRA accounts. Excludes 457, 529, and non-ERISA 403(b) plans.