Bitcoin Revisited

We last wrote about bitcoin in our Spring 2018 Newsletter article titled Bitcoin, Bubbles, and the Fear of Missing Out, which was written just about the time that Bitcoin prices were peaking near $18,000. Within a year, the price of a bitcoin dropped be- low $4,000. Fast forward 3 years and we see bitcoin recently trading as high as $63,000 – and we are once again getting questions about owning bitcoin. Of note, as we write this, bitcoin has fallen nearly 50% from its recent peak – which goes to show how volatile an asset Bitcoin really is.

So, does it make sense to own bitcoin and is now the time to buy it? As you might imagine, this is no easy question to answer! We will attempt to come at the question from a pros and cons approach to help make some sense of bitcoin.

First, let’s look at reasons that owning bitcoin makes sense:

- Bitcoin is very liquid, ably traded on over 300 different cryptocurrency exchanges.

- Perhaps the most compelling reason to own bitcoin

is that there will only ever be 21 million of them, once fully “mined”. Currently 18.7 million exist. This is appealing in that the supply is fixed (unlike traditional currencies), while demand for it is potentially unlimited. - Bitcoin is globally portable, unlike currencies and precious metals which have to be declared when crossing country boundaries. As an aside, this is especially attractive to criminals.

- Bitcoin is gaining institutional credence, some- thing not previously seen. Successful and rational investors like Paul Tudor Jones and Bill Miller are suggesting owning some bitcoin as a dollar hedge and some companies like Tesla have invested in it in lieu of cash.

Now, let’s look at reasons to be cautious on owning bitcoin:

- Bitcoin is extremely volatile, unlike most any currency or precious metal. As seen in the chart on page 1, it is not at all unusual for bitcoin to see price declines of 20-50% – eleven times in the last four years alone. Owning it is not for the faint of heart.

- It is very expensive to transact in bitcoin, especially for smaller purchases, unlike traditional currencies where transaction costs are very low and zero in the case of physical cash.

- Bitcoin is a digital intangible asset, basically in the form of zeros and ones, unlike cash and precious metals that you can touch and feel (of course, most dollars are kept in digital form in banks).

- Bitcoin has no intrinsic value. It is not used to make anything. It is only worth whatever one thinks it is worth, so it requires investor confidence, which can be a fickle thing. Said another way, it should be considered a speculative asset.

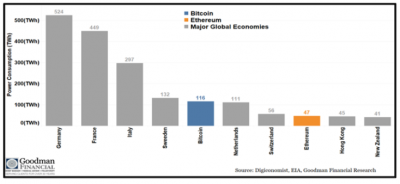

- Bitcoin is not very ESG friendly. The amount of electricity required to mine bitcoin is roughly equivalent to that used annually by Sweden – what we call bitcoin’s dirty little secret. (see chart be- low)

- Probably the biggest reason to be cautious with bitcoin is that governments absolute hate it. This is not surprising in that they can’t easily control it and it offers an alternative to their fiat currencies. In fact, the recent tumble in bitcoin prices was attributed to both some new policies in China to crack down on bitcoin as well as the IRS announcing new measures to track and tax gains on sales of all cryptocurrencies.

Hopefully, we have given the reader some useful information to ponder if they are evaluating owning bitcoin. At this time, we believe the risks of owning bitcoin outweigh the reasons to own it. If one does decide to own some bitcoin, given its speculative nature and considerable risks, we would counsel against owning anything more than a small position, which would be outside our managed portfolios.