Back-of-the-Napkin Math Is Not Good Enough: The Importance of True Financial Planning

When it comes to the quality of the rest of your life and your legacy, back-of-the-napkin math is not good enough. The decisions you make now, can have lasting, long-term impacts, and we want to ensure that you are equipped to make informed decisions along the way.

While each of us has a unique vision for our retirement based on our personal values, goals, preferences, and financial circumstances, we share a number of life events and milestones that require thoughtful choices. A few financial examples include Social Security, Medicare, Qualified Charitable Distributions, and Required Minimum Distributions (RMDs).

This month, our Financial Advisory Update will walk through some key planning areas with a focus on goals to consider, pivotal decisions to be made, and the potential impact of those decisions on the probability you will be able to fully fund the retirement you envision.

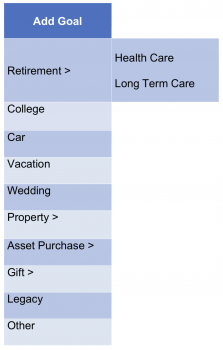

Goals to Consider – The Scope of Your Plan

As you work with your Senior Financial Advisor to develop or refine your long-term Financial Plan, it is important to take quality time to consider not only your needs, but the legacy you want to design—What impact do you want to make? Your goals may extend beyond you and your family and include other loved ones, caregivers, charitable giving, philanthropy, etc. As Stephen Covey suggested in the book, The 7 Habits of Highly Effective People, “Begin with the end in mind.”

It is estimated that 1 in 4 people age 65 today will live past age 90, according to the Social Security Administration. Given that you may be planning for a good 30 years or more in retirement, it is important that your Financial Plan include more than your customary pre- or post-retirement living expenses (housing, insurance, food, transportation, utilities, entertainment, charitable giving, etc.). We recommend that you also:

- Consider adding a Long-term Care Goal(s). The U.S. Department of Health and Human Services indicates that 70% of people turning age 65 can expect to use some form of long-term care during their lives. Those in the “sandwich generation”, those who care for both their aging parents and their own children, may need to plan for not only their own long-term care, but that of another.

- Separate your Health Care Goal and any Education Goals from your estimated, ongoing Retirement Expenses, if you would like to inflate Health Care and/or Education expenses at a higher percentage than general Retirement Expenses.

- When appropriate, ensure applicable Goals are defined as “recurring” vs. one-time, e.g., Home improvement/repairs, Car purchases, Vacations.

- Include potential life events given your unique circumstances, extended family and friends, and personal bucket list.

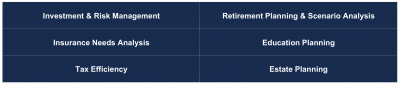

Once defined, to increase the probability that you will be able to fully fund your goals, your Senior Financial Advisor will explore considerations and strategies with you in several key areas:

This month, we will introduce four pivotal Retirement decisions, with a focus on Social Security considerations. Next month, we will dive deeper into Distribution Strategies.

In addition to some of the basic decisions many of us think about, such as “When should I retire?” and “What lifestyle can I afford?”, there are a number of financial decisions we must make that directly impact the amount of money we will have to fund retirement.

- When should I take Social Security to optimize my benefits?

- When funding my retirement needs, which account should I withdraw from first?

- Does it make sense for me to use a Roth Conversion to possibly reduce my tax liability in the future, and if so, when and for what amount(s)?

- Should I employ Qualified Charitable Distributions to reduce my taxable income? Social Security: “When should I take Social Security to optimize my benefits?”

If eligible, each of us must decide if we should claim benefits earlier and receive a smaller monthly payment for more years, or wait, and receive a larger monthly amount over a shorter period.

- If you’ve contributed enough to the Social Security system through FICA payroll taxes, you can receive your full retirement benefit sometime between ages 66 or 67 depending on when you were born.

- You may also claim it sooner, starting at age 62, at a permanently reduced rate.

- Or, you may wait until after your full retirement age, increasing your benefit amount by up to 8 percent per full year to age 70.

When selecting the option that is optimal for you, the Social Security Administration encourages you to consider four important questions:

- HOW MUCH MONEY WILL I NEED TO LIVE COMFORTABLY IN RETIREMENT?

The Associated cost of your goals will help answer that question. - WHAT WILL MY MONTHLY SOCIAL SECURITY RETIREMENT BENEFIT BE?

The most accurate estimate of your retirement benefit can be obtained at www.ssa.gov. - WILL I HAVE OTHER INCOME TO SUPPLEMENT MY SOCIAL SECURITY BENEFITS?

Having other income to supplement Social Security benefits is critical. For high earners, Social Security is estimated to replace roughly 27 percent of a person’s annual pre-retirement earnings. (On average, the number is closer to 40 percent.) - HOW LONG DO I EXPECT MY RETIREMENT TO LAST?

To determine the length of your retirement, consider your health, family longevity, and lifestyle.

Please note that when you die, certain members of your family may be eligible for survivor benefits. Your decision on when to take Social Security will affect your survivors as well. Your Senior Financial Advisor will work with you to evaluate multiple scenarios so that you are making a thoughtful, informed decision. We utilize sophisticated software to help analyze the best Social Security claiming strategies for our Clients.

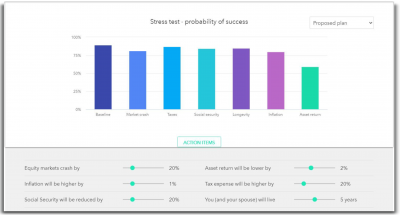

Probability of Success – Current Scenario, Proposed Plan, and Stress Testing

A holistic plan enables you to obtain a current snapshot of the probability that you will be able to fully fund the retirement you envision and then allows you to adjust your assumptions and test different strategies to enable you to make informed decisions.

Once you have solidified your plan, your Senior Financial Advisor will stress test the plan. Even the strongest retirement plans will be exposed to risks, such as market volatility, taxation, decreases to Social Security payments, longevity, and inflation. You will be in a position to not only anticipate these risks, but to plan for them. As shown below, you will be able to easily adjust your assumptions and see the potential impact on your probability to fully fund the retirement you envision.

As your circumstances, goals, and life continue to evolve, we will continue to work with you side-by-side to make any necessary adjustments to your plan and resulting strategies to help you get from where you are today to where you want to be.