Passive Investing and Bubbles Oh My: The Impending Arrival of The Bogle Bubble

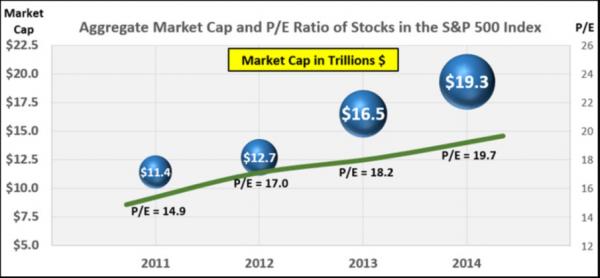

In recent years there has been increased acceptance of using passive investing methods, with the most popular one being investing in the various mutual funds and exchange traded funds (ETFs) tracking the S&P 500 Index. This approach has been popularized by Vanguard and its founder, John C. Bogle. In fact, there are now over 1,000 funds with a collective $1.9 trillion in assets that track the S&P 500 Index. As each dollar is added to those funds, that amount is divided among the 500 stocks in the index. With its growing popularity, the sheer magnitude of these passively invested dollars is serving to inflate the values of these 500 stocks. The graphic below reflects this phenomenon. There is nothing unusual about the valuation rising with earnings, provided P/E ratios (price divided by earnings) are relatively stable, but ever increasing earnings multiples are indicative of a bubble. We have included the P/E ratio for each time period to demonstrate that the growth in market cap is not driven solely by earnings increases, but also by higher earning multiples. In other words, these 500 stocks are becoming pricier every year.

If the inflation in the valuations of the holdings of these 500 stocks isn’t enough risk, consider that as more passive index fund owners pile into these stocks it will crowd out the active managers as well as the activist managers. This will reduce the scrutiny that active fund analysts place on the stocks as well as accountability that is the hallmark of the activists. Further, passive investing precludes use of many of the benefits of active investing, including tax-efficient investing, as well as the additional financial advisory services provided by many of the active managers. Now we are not suggesting such bubble is in imminent danger of pop-ping or deflating, at least not yet. In fact, we expect that the 2014 under performance of most active managers will cause the shift to passive funds to accelerate. Further, the inclusion of S&P 500 index funds in 401(k) plans, institutional portfolios, and individual investor accounts will continue to inflate and boost values of these companies, to a point (hopefully not a sharp point).

If the inflation in the valuations of the holdings of these 500 stocks isn’t enough risk, consider that as more passive index fund owners pile into these stocks it will crowd out the active managers as well as the activist managers. This will reduce the scrutiny that active fund analysts place on the stocks as well as accountability that is the hallmark of the activists. Further, passive investing precludes use of many of the benefits of active investing, including tax-efficient investing, as well as the additional financial advisory services provided by many of the active managers. Now we are not suggesting such bubble is in imminent danger of pop-ping or deflating, at least not yet. In fact, we expect that the 2014 under performance of most active managers will cause the shift to passive funds to accelerate. Further, the inclusion of S&P 500 index funds in 401(k) plans, institutional portfolios, and individual investor accounts will continue to inflate and boost values of these companies, to a point (hopefully not a sharp point).

Likely this phenomenon will continue throughout most of 2015, and possibly beyond. For that reason, going into this period we have included seventeen members of the S&P 500 among our core holdings. Our ability to monitor each holding separately should allow us to benefit from impending gains as well as reduce these positions as their valuations reach extremes. We will also use S&P 500 funds selectively as place setters for un-invested funds, in 401(k) accounts restricted to fund options, and in smaller accounts for diversification. Keep in mind, anything that is out of equilibrium will move to equilibrium given time.