Emotions: An Investor’s Worst Enemy

Many species, including humans, have sought security in herds and the familiar. While this behavior has ensured our survival over the centuries, it is unfortunately detrimental to investing. In an effort to mitigate losses and maximize gains investors take a short-term approach that is rarely beneficial in the long term. Emotions and near-sighted investing go hand in hand. Some common emotional reactions to fluctuations in market conditions include following the herd and the familiarity bias. The result is often to sell low and buy high, the opposite of successful investing.

By “following the herd” we mean taking part in “manias,” “panics,” and “momentum investing.” Manias involve a rapid rise in the value of an investment, while panics involve a rapid decrease in the value of an investment. Manias and panics are the result of investors piling into a sudden shift in a trend. These investors are usually acting without considering the fundamentals of the investment. Some investors make a strategy out of this called “momentum investing.” This strategy assumes that increases in price will be subsequently followed by additional increases, or decreases by decreases. Fear and excitement are emotions that are best left out of your investment decisions.

“Familiarity bias” occurs when someone invests in a particular industry or company purely due to their personal familiarity with it. The downside of this bias is the tendency to forgo fundamental analysis in favor of the familiar as well as the potential lack of diversification. We suggest investors should also consider their profession (knowledge of and exposure to certain industries) as part of their portfolio when assessing diversification. Diversification helps smooth out the volatility of the portfolio and an investor’s emotions, resulting in an improved risk-return profile.

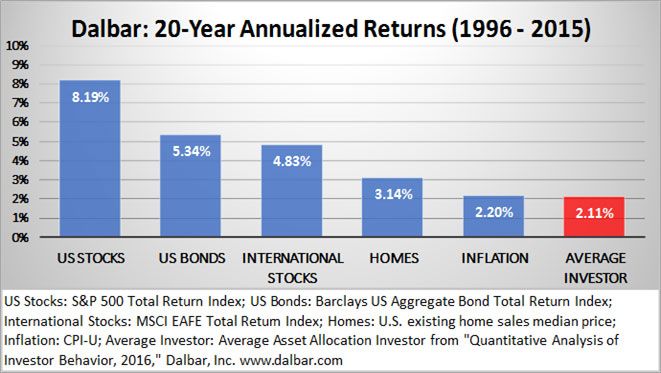

According to the Dalbar study referenced in the chart below, the leading cause of underperformance is investors’ behavior due to emotional investing. Emotion-based investment decisions lead to deviations from one’s investment strategies and can prolong achievement of goals and/or require investors to eliminate some of their goals.

Instead of emotional investing, we suggest fundamental investing with an eye towards the long term and a holistic understanding of your risk tolerance. This can be done by determining a realistic risk tolerance and aligning your asset allocation accordingly. Having asset allocations set appropriately provides investors with the confidence that the portfolio should have market volatility the investor can withstand. This does not mean to set an asset allocation and put on blinders when the market becomes volatile. It means managing your expectations so that emotions do not lead to short-sighted emotional decisions. There may be times over the course of an investment when it is prudent to cut losses or take gains. These decisions should be made based on reasonably comprehensive analysis of the investment and the market.