Bitcoin, Bubbles, and the Fear of Missing Out

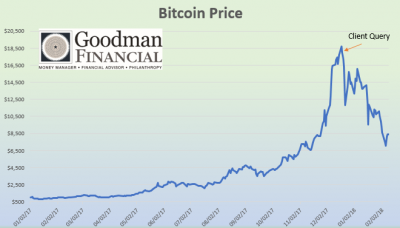

We thought it would be instructive to share some of the thoughts from our response on December 21, 2017 to a client query about Bitcoin. This article highlights and expands on those thoughts.

There is something in human nature that compels individuals to want to invest in things that have already gone up tremendously in price (let’s call those “manias”). Some might describe that compulsion as the “fear of missing out” (FOMO) after watching others get rich in some type of “investment”. This behavior is not some recent phenomenon; it’s as old as time. Most readers have heard of one of the most famous manias of all, the Tulip Bulb craze – going all the way back to 1636 when the price of rare tulip bulbs (of all things!) went up over 800% in a matter of months. Of course, we are writing about today’s mania – Bitcoin (or really any of the over 1,500 different so-called cryptocurrencies, of which Bitcoin is the most well-known).

There are some commonalities among all manias. First, the price of the underlying investment goes up way beyond any fundamental or intrinsic value and then usually, the investment goes on to be even more expensive and overvalued. At this point investors become speculators, speculating that there is some greater fool than themselves to which they in turn can sell. Because of this, there is no way to predict how high the price of something can go up. For example, Bitcoin might have seemed expensive in August of 2017 when it hit $4,000, after quadrupling from the start of the year…and then it went up to nearly $19,000! This brings us to another common thing about manias; price increases often become exponential towards the ultimate top, what some might call the blowout phase. This is also the most dangerous phase – where FOMO kicks into high gear, usually lubricated by headlines of previous investors getting fantastically wealthy. Finally, all manias end in a trail of tears where many investors lose most or even all of their invested capital. There are some who would say Bitcoin is not a mania but a new alternative digital currency and that skeptics just don’t get it. Count us as skeptics.

A prudent investment is something that has some type of output such as an income stream, or growth based on a future income stream; Bitcoin has neither. A true currency needs to demonstrate stability to be widely adopted and Bitcoin has shown incredible volatility. Many countries have begun to outlaw or severely restrict or regulate the use or exchange of Bitcoin (we’ll ignore all the reasons why – that’s a whole other article!). Some who invested in Bitcoin and other cryptocurrencies have also seen their investments magically disappear because of digital thefts, amounting to hundreds of millions of dollars, and with reports of new thefts coming with frightening frequency.

So, why are we writing about manias and Bitcoin? It is to remind the reader that FOMO is a real human emotion and we need to recognize it when it hits. It is also to remind us that sometimes the decision to avoid certain investments are the best decisions!